Tired of the rapid Naria devaluation?

Looking for the best ways to secure your future finances while living in Nigeria?

Want to discover the best apps to save in dollars in Nigeria?

In this post, you will find some of the most reliable platforms and apps to save money in dollars in Nigeria (and other countries with unstable currencies). You’ll also learn why you may want to stop saving in Naira or your local currency.

Why you should start saving in dollars in nigeria

If you are wondering why you should save In dollars in Nigeria, here’s why;

The United States dollar, aside from being one of the strongest and most traded currencies in the foreign exchange market; is a go to currency for people living in countries with economic crises and devalued local currencies.

Few years ago, a dollar was between 195 – 199 Naira.

How much is 1 dollar in Nigeria now?

As at January 2023, the same naira is sitting pretty at 745 naira per dollar. Crazy! I must say!

We have to admit a bitter truth, Nigeria as a country is amid economic crisis. The local currency is experiencing rapid market devaluation because of the country’s inability to diversify its economy.

Also, the unfriendly policies and clampdown on technological development plays a major role in the present sickening condition. The Nigerian Naira has lost over 50% of its value in just 1 year!

While there is little to nothing the citizens can do, securing their finances becomes a necessity.

In my last post, I wrote about platforms that offer good interest rates for saving in Naira; but, I assume you want more, a better saving opportunity that secures your finances even more.

So, if you have asked yourself, “Which app can I save in dollars?” This post will answer your questions.

If you hate seeing your money lose value due to inflation and the government’s unfriendly policies, then you are better off saving in dollars. There are several apps for saving dollars in Nigeria and I will discus them in this post.

How to start saving in dollars in Nigeria

Over the years, saving dollars became easily accessible in Nigeria and many other countries due to the widespread use of fintech apps and cryptocurrencies.

Blockchain networks introduced digital versions of the United States dollars, while most fintech apps enabled access to saving in dollars.

This gives individuals an opportunity to own and start saving in dollars in Nigeria without owning domiciliary accounts.

The only requirement needed to own the blockchain version of the US Dollar is to have access to an exchange or a crypto wallet you can fund and withdraw from.

The Best Platforms and Apps to Save in Dollars in Nigeria

This post will enlighten you about the best apps that will reward you for saving in dollars.

The platforms and apps you’ll find in this article are open to just anyone looking to save money in dollars.

You don’t have to be Nigerian to use them. You’ll find some crypto and non crypto companies that you can save in.

Muna Wallet

Top of the list in this post is Muna app, a crypto wallet that enables people to earn while they save. You can save USDN, WAVES, Binance coin, Bitcoin, Muna and more.

Muna enables saving in USD for their users through USDN, a stable coin pegged to the United States Dollar.

They offer 5 savings plans, 1 flexible plan and 4 locked plans to help you stay dedicated to your goal.

Each plan offers up to 15% annual savings interest; and the best part is, you’ll receive your rewards every day until you withdraw your funds.

Note – the locked plans have a 3% default fee for early withdrawals.

Muna is one of the easiest ways to save in dollars in Nigeria as they offer quick, easy and secure deposits/withdrawals to people living in Nigeria.

Non-Nigerians can send and receive supported crypto coins from other crypto wallets or exchanges to save.

Save in dollars in Nigeria with Piggyvest’s Flex Dollar

Piggyvest is one of the most popular saving apps in Nigeria. Apart from the opportunity to save naira, they also allow you to save in dollars in Nigeria with their flex dollar plan.

You can earn up to 7% annual savings interest when you save in dollars on Piggyvest. Every month, they pay out savings rewards to your flex dollar account.

To save in dollars on Piggyvest, you need to fund your account with naira, then deposit it to your flex dollar account at the naira to dollar exchange rate.

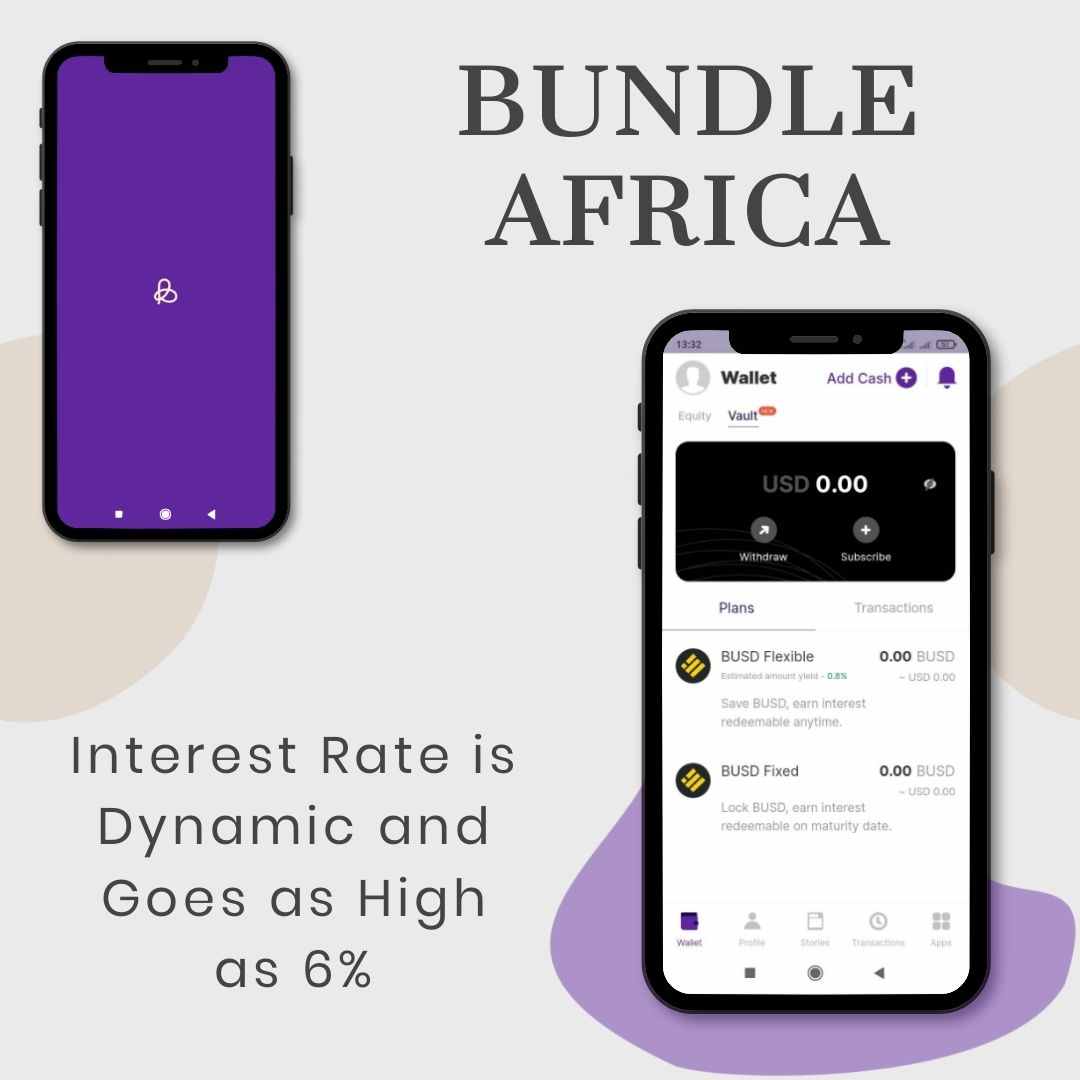

Bundle Africa Vault

Bundle Africa is the second crypto wallet in this post. They offer Nigerians an opportunity to save cryptocurrencies, including BUSD, a stable coin pegged to the United States Dollar.

Bundle enables saving in USD for their users through BUSD. You can save as low as 0.1 BUSD.

Earn up to 6% annual interest when you save on Bundle.

Note – you cannot withdraw from the fixed BUSD plan until its due date.

You can easily fund your account on Bundle Africa through their secure P2P exchange method that connects you with other Nigerians looking to buy and sell.

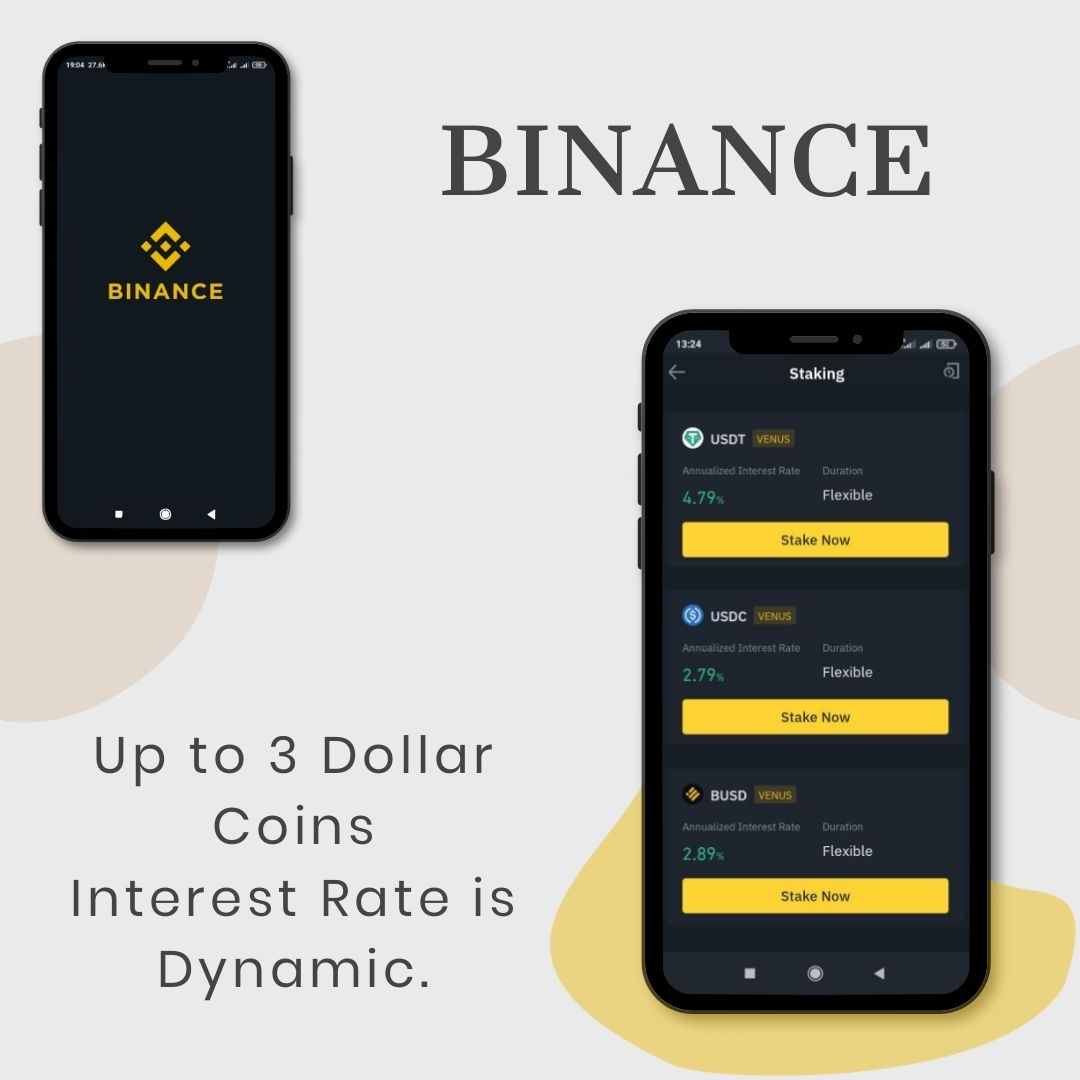

Binance Exchange

Binance, one of the largest crypto trading markets, is more than just an exchange platform. You can also save different cryptocurrencies with them.

They enable you to save in dollars with different USD coins you can choose from.

These are some of the USD coins you can save on Binance.

- USDT

- USDC

- BUSD

While there is no direct deposit option, you can easily fund your Binance account through their secure P2P exchange method that connects you with other Nigerians looking to sell and buy funds in Binance.

There are different traders to choose from, but ensure you follow the Binance P2P rules for your financial safety.

Waves Exchange

Waves exchange is another crypto trading platform that allows their users to save in dollars. They offer competitive interest rates and enable USD saving through USDN.

While this is another great platform to use, funding your wallet might take a bit of time to master since there is no direct deposit method for Nigerians. You should use Muna instead if you want to save in dollars via USDN.

What Platform is the Best For You?

While the aforementioned platforms offer you a great and easy opportunity to save in dollars in Nigeria, it’s important you choose the best for you.

I currently use and recommend Muna because they have one of the best interest rates and offer a secure and quick funding method; you buy and sell directly to them.

Do you use a different platform or app for saving in dollar?

Do share!